Schedule K 1 Form 1120s 2024 Pdf

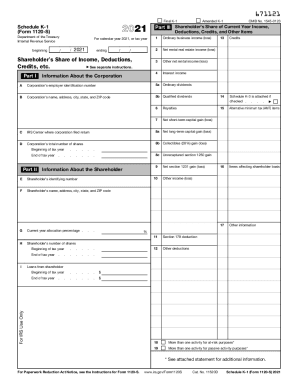

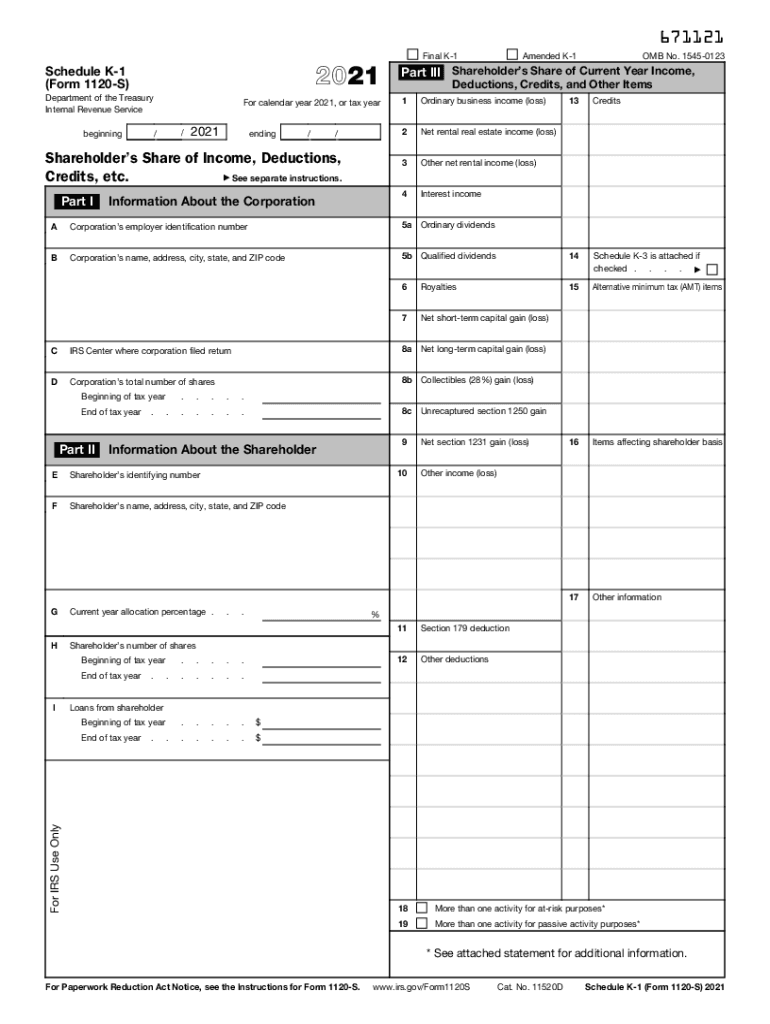

Schedule K-1 Form 1120s 2024 Pdf – Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . Businesses structured as S corporations can deduct payroll tax expenses on line 12 of Form 1120S. Only the employer corporation shareholders on a Schedule K-1. Businesses set up as .

Schedule K-1 Form 1120s 2024 Pdf

Source : support.taxslayer.comIRS Schedule K 1 (1120 S form) | pdfFiller

Source : www.pdffiller.com120SK11204 Form 1120 S Schedule K 1 Shareholder’s Share of

Source : www.nelcosolutions.comSchedule k 1 form 1120s 2021: Fill out & sign online | DocHub

Source : www.dochub.com3.12.217 Error Resolution Instructions for Form 1120 S | Internal

Source : www.irs.govIRS Instruction 1120S Schedule K 1 2022 2024 Fill and Sign

Source : www.uslegalforms.comIRS Form 1120S Schedule K 1 (2020) Shareholder’s Share of Income

Source : docs.ocrolus.comK 1 box 17 code ac gross receipts: Fill out & sign online | DocHub

Source : www.dochub.comWhat is K1 for Taxes 2021 2024 Form Fill Out and Sign Printable

Source : www.signnow.comEditable Schedule K 1 (1120 S form) Templates | DocHub

Source : www.dochub.comSchedule K-1 Form 1120s 2024 Pdf Schedule K 1 (Form 1120 S) Shareholder’s Share of Income : The Schedule K-1 must be filed by the same deadline as the Form 1120S. Two copies of the Schedule K-1 must be completed for each shareholder. One copy goes to the shareholder, while the other copy . Businesses electing to be taxed as an S corporation will prepare Form 1120-S, declaring their income for the year. Like a partnership, you’ll prepare a Schedule K-1 to declare each shareholder’s .

]]>